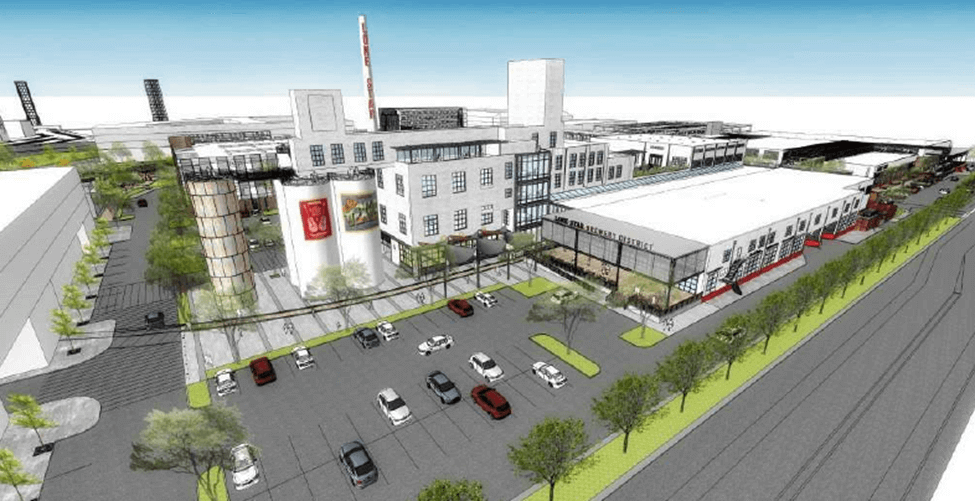

BridgeInvest Closes $11.0 MM Refinance Loan on Landmark Property in San Antonio

1st Priority Deed of Trust

Southeast focused real estate lender, BridgeInvest, closed an $11.0 MM first-priority, land refinance loan secured by a 32-acre development site in San Antonio, Texas. The site is currently home to the former Lone Star Brewery which the borrower plans to redevelop into a premier mixed-use destination along the San Antonio River and just south of the city’s central business district. The project would include hundreds of apartments, a hotel, office space and retail shops that will complement the area’s culture and history. The loan allowed the borrower to refinance his existing debt with a pending maturity and provide time to proceed with the appropriate development plan.

Transaction Highlights

Non Cash-Flowing Asset

BridgeInvest was able to close the loan within the necessary time frame despite the lack of cash-flow from the property.

Subordinate Financing

BridgeInvest worked with the borrower and the in-place junior lender to refinance the existing senior mortgage.

Flexible Structure

The loan structure allowed the borrower to accrue a portion of the interest costs until maturity to allow for increased flexibility in executing their business plan.